ETFs vs Individual Stocks: Advantages & Differences

Stocks, Exchange Trades Funds (ETFs), Mutual Funds, and Bonds are integral parts of a balanced portfolio. ETF is the youngest among the most popular investment avenues, while stock investment is like the great-grandfather of all financial assets.

ETFs vs. Stocks Contents

- ETFs and the stocks : The beginning

- What are ETFs and Stocks?

- ETFs vs. Stocks: Characteristics and Comparison

- Pros and cons of ETFs

- Pros and cons of stocks

- The Verdict

ETFs and Stocks: The beginning

The world’s first ETF was created in Canada in 1990. The first U.S ETF was launched in 1993 and during its initial days, institutional investors used ETFs to execute trading strategies. Swiftly, it became the favorite of retail investors as well as financial advisers.

Today, ETF represents everything from broad market indices to alternative asset classes.

On the other hand, trading in stock has started in the 1500s and first publicly trading in a company started in the 1600s at Amsterdam Stock Exchange.

What are ETFs and Stocks?

An ETF is a basket of financial assets like stocks, bonds, commodities, etc. that are traded in a stock exchange.

Trading of ETF is just like that of a share- the investors can buy and sell them through a broker. To start trading in the ETF, the investors need a brokerage account. Just like a mutual fund, ETF allows diversification and at the same time, gives the flexibility of stock trading. These characteristics make ETF one of the best accessible and potential assets.

Working of ETF:

An ETF is a type of fund that owns assets and its ownership is divided into shares that trade on stock exchanges.

Every ETF carries a unique ticker. The investors can buy and sell the shares of the baskets of their choices during the trading hours, just like the common shares.

The price of ETF changes in real-time. But unlike stocks, the number of outstanding shares changes daily basis depending on the share creation and redemption mechanism.

A stock is the most popular investment avenue of the present. While purchasing the shares of a company, the investor buys a part of the business and owns voting rights.

The shareholders enjoy the rights to take actions against the directors, the rights to check the registers and the documents, etc. There are different categories of stocks that fit-in the goals of various types of investors and they are: growth stocks, blue-chip stocks, income stocks, cyclical stocks, defensive stocks, value stocks, and speculative stocks.

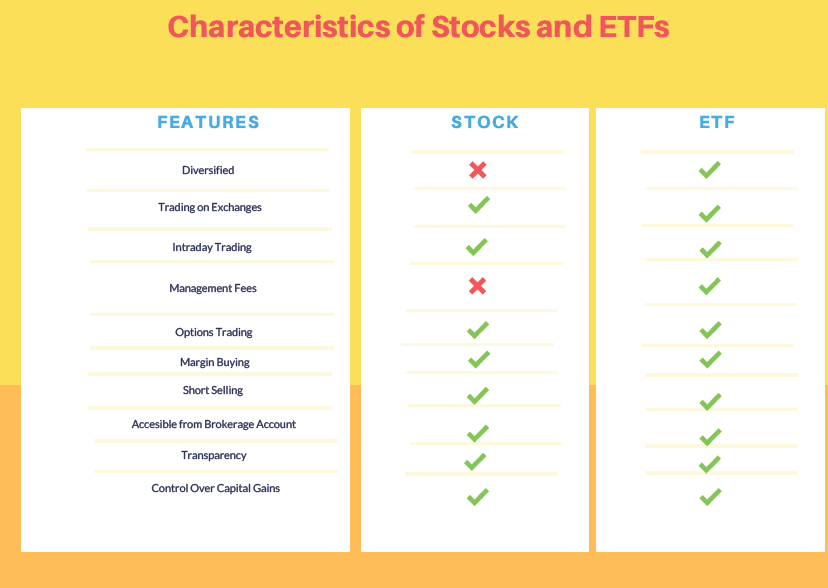

ETFs vs. Stocks: Characteristics and Comparison

Comparison of ETFs and Stocks

|

Basis |

Stocks |

ETFs |

|

Definition |

The stocks represent the ownership of investors in a company. |

ETF is a basket of securities and traded much like stocks. ETF holds assets like stocks, commodities, or bonds. |

|

Type of investment

|

Stock investment can be an active or passive investment and it depends upon the investor. The active investment approach takes advantage of short-term fluctuations and carries a lot of risks. The active approach takes a lot of time as it requires proper research on companies before picking stocks. On the other hand, passive investments involve selecting stocks that have the potential to grow over a while and can deliver a good return in the long-term with minimum involvement. |

Passive investment. The primary goal of passive investment is to earn a market return rather than outperform the underlying index. It’s based on the concept that an investor should invest in a broader selection of stocks or other securities rather than trying to pick single ones that will give huge returns. The passive approach doesn’t require any research on companies or securities. |

|

Risk |

The risk associated with the stocks is measured in terms of beta. The value of beta varies with companies, industries, etc. Higher the value of beta, the higher the risk and higher the risk, the higher the returns. |

ETFs are comparatively lesser riskier than stocks as they consist of a basket of investments, i.e., they are diversified. The risk of ETFs depends upon the types of the underlying securities. Various risks of ETFs are:

|

|

Returns

|

Stock investments have a history of giving higher returns that can beat inflation. The average annual return of the stock market stood at 10%. |

The returns of ETFs depend upon the performance of the underlying assets. Typically, their performance will be in line with the index. |

|

Liquidity |

Stocks are highly liquid, i.e., the investors can convert them easily into cash. However, some exceptions are there. Investors may find difficulty in trading illiquid shares. |

The liquidity of ETF depends upon the underlying asset. Usually, it’s as liquid as stocks. The volume of ETF may also determine its liquidity. |

|

Fees |

The broker charges fees for every trade and it varies from broker to broker. |

As ETFs trade like stocks, the investors need to pay commission to the broker on every buy and sell. Apart from the brokerage, the investors of ETF need to pay expense ratio. The average the expense ratio of ETF stood at 0.44%. |

|

Diversification |

Diversification is difficult in stock investing. For a diversified portfolio of stocks, the investors need to buy shares of various companies from different sectors. It requires a lot of research to pick good quality stocks and it’s tough to track all the companies single-handedly. |

Diversification is comfortable with ETFs as the baskets contain a combination of securities. Investing in ETFs is an effective way to diversify the portfolio. |

|

Taxation

|

Gains from the sale of stocks are taxable and they are taxed as per the nature of the profits, i.e., short-term or long-term gains. Short-term gains are taxed at the regular income tax rate while long-term gains are taxed according to the tax bracket of the investor. |

The taxation of ETFs lies in the same way as its underlying assets. However, precious metal ETFs are taxed as a collectible, i.e., at a rate of 28%. ETF dividends are also taxable. If the investor holds the ETF for more than 60 days before the issue of the dividend, then it’ll be taxed as per the tax bracket of the investor else the dividends will be taxed as ordinary income. |

Pros and Cons of ETFs

Pros

Flexibility

ETFs offer a lot of flexibility over other investment options. Even though ETFs are funds, they trade like shares.

Exchange trading gives them transparency and liquidity. The holdings of ETFs are disclosed each day to the public. Even the investors of ETFs can enjoy margin trading as well as short selling.

Easy Diversification

ETFs are a convenient way to access a wide variety of stocks, industries, or countries. Today, ETFs are traded on every significant asset class, commodities, and currencies across the world.

ETFs are designed to provide easy exposure to a specific desired market segment.

Single Transaction and Multiple Benefits

As ETFs contain a basket of assets, with a single transaction, the investor can buy a portfolio. It lowers the transaction cost while on the other hand, trading of multiple stocks involves a lot of commissions.

Cons

Lower Returns

ETFs follow passive investment strategies. So, they are not expected to outperform the indices. Thus, at times, their returns may not be able to beat inflation.

Low Trading Volumes

Many ETFs are thinly traded ones, i.e., the trading volumes are very less. It provides a wide bid-ask spread and lowers liquidity and thus diminishes the cost-effectiveness of ETFs.

Due to lower trading volume, many investors find it challenging to sell ETFs.

Higher Trading Cost

ETFs carry expense ratio as well as the broker commission. It takes the trading cost to a much higher side in comparison with stocks.

While many brokers have dropped the brokerages for ETFs but still the stocks look attractive from this point of view.

Investment Horizon Problems

Due to intraday trading facilities, a majority of the investors look ETFs as a short-term instrument rather than a long-term strategy.

It lowers the return and at the same time, increases the trading expenses as well as tax burden.

Pros and Cons of Stocks

Pros

Higher Returns

Stocks have the highest return than any other investments over the long run. Historically the stock market has returned an average of 10% annually before inflation. Depends upon the volatility in the market, the returns vary each year. And in a particular year, the return may be far from the average.

The shareholders usually get two types of capital appreciations on their investments and they are the price appreciation and dividends. Not all companies need to give dividends every year. But few companies have a history of paying dividends regularly.

Control Over Investments

The investors have full control over the investment decisions, i.e., when to buy/sell the shares. The gains from the sale of shares are taxable. So, depending upon the tax planning, shareholders can take the offloading choices.

In many circumstances, re-balancing and restructuring of the portfolio are necessary. Depends upon their risk appetite, the shareholders can make decisions on their portfolio.

Transparency

Shares are traded in the exchanges and the process of the stock market is very transparent. Transparency is nothing but the extent to which the investors get the information about the companies.

Transparency helps to reduce price volatility. All the market players have an equal right to the information about the share prices, financial performance of the companies, and market depth.

Market depth refers to the ability of the securities to tolerate the execution of large orders without having a massive influence on the price.

Cons

High Volatility

One of the biggest disadvantages of stock market investment is that it's highly volatile. The share prices rise and fall upon the demand and the supply.

There are various types of risks associated with stock market investments. Market conditions, political events, and even the company-specific factors can influence the price. So there is no guarantee on the returns.

Not Suitable for Retirement Income

Usually, retirees need a regular income and the stock market doesn't guarantee a regular income.

Many stocks pay little or no dividends. So, investors who are nearing their retirement should reduce their exposure to stocks and pool their money into much safer and guaranteed returned avenues.

Plenty of Choices

There are thousands of companies listed in the stock market, which leaves a large number of choices for investments.

It can be discouraging many times as it takes a lot of research and sound knowledge to identify good stocks. Many individual investors find it challenging to meet their investment goals due to the complexity and size of the market.

The Verdict

Both the stocks and ETFs have their advantages and disadvantages. They both have good potential to create wealth over the long-term.

Depending upon the risk appetite and investment goals, the investors can make the choices.

However, before making the investment decisions, proper research on the risk and the reward is highly recommended.

Tag: etf vs stocks performance, etf vs stocks difference