World’s Top Stock Exchanges

In the current era, the importance of stock exchanges is very significant in the world economy due to the fast expansion of the global financial market.

At present, there are numerous stock exchanges across the world. But there are few exchanges, which are more than a century old but still stand tall in the crowd.

Want to learn Stock Market Techniques through hands on practice, without the risk of loosing money? Have a look to worlds top free stock simulators

Over the years, these exchanges have gone through different phases of evolution- from open outcry era to the e-trading age.

Below is the list of worlds largest stock exchanges by market capitalization -

- NASDAQ

- New York Stock Exchange (NYSE)

- The Toronto Stock Exchange (TSX)

- The Bombay Stock Exchange (BSE)

- London Stock Exchange (LSE)

- Shanghai Stock Exchange (SSE)

- Japan Exchange Group (JPX)

- Australian Securities Exchange (ASX)

- Deutsche Börse Group

- Euronext N.V.

- The Stock Exchange of Hong Kong (SEHK)

National Association of Securities Dealers Automated Quotation (NASDAQ)

The largest US electronic stock market;

the world’s second-largest stock market;

Home to leading companies across the industries

The synonyms of the NASDAQ stock market are not ending here.

It’s the US’s largest electronic stock market in terms of shares traded and the second largest in terms of market capitalization.

The NASDAQ stock market has been organized differently from the traditional stock exchanges.

Instead of having a physical location, it’s held entirely on a network of computers and all trades are performed electronically.

This had given it an edge over the other markets.

This is the world’s first electronic stock market. Due to the immense competition between the NASDAQ stock market and NYSE, both the exchanges came-up with many innovations and it also helped them to expand a lot.

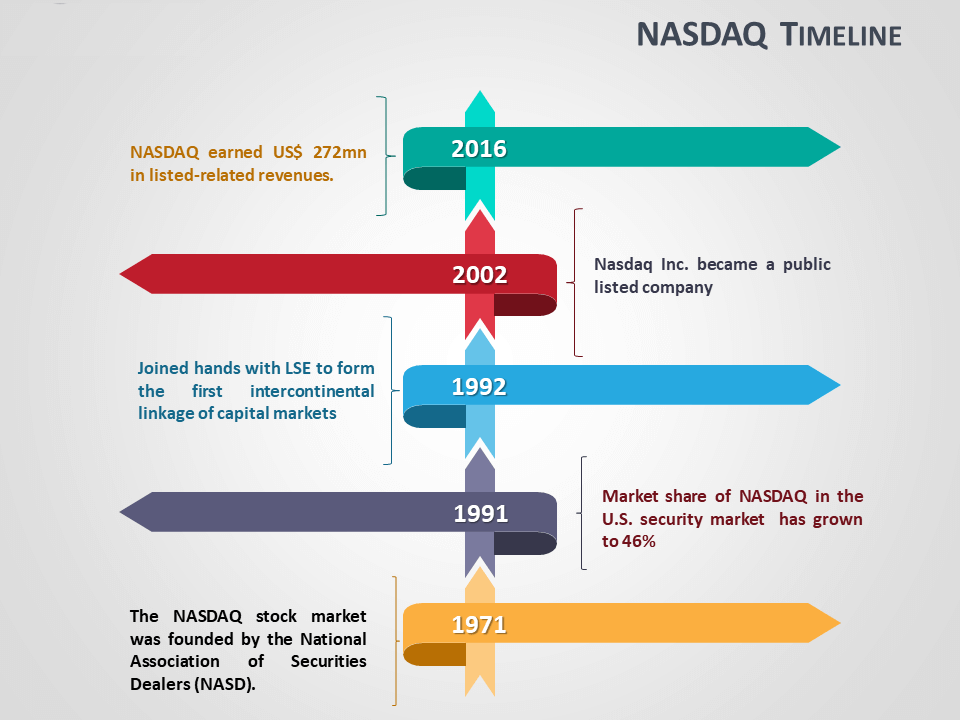

The NASDAQ stock market was founded in 1971 by the National Association of Securities Dealers (NASD).

Currently, it’s owned and opened by Nasdaq Inc.

Over the years, it’s added more companies than any other stock exchanges. So the trade and volume also increased.

In 1981, NASDAQ traded 37% of the US security market’s share and by 1991, this share rose to 46%.

The main indices of this stock market are NASDAQ Composite, NASDAQ-100, NASDAQ Financial-100, etc.

In 1992, in association with the London Stock Exchange, it formed the first intercontinental linkage of capital markets.

New York Stock Exchange (NYSE)

Located in Wall Street in New York City, NYSE is the world’s largest and most liquid cash stock exchange which has a market cap of more than US$ 28 trillion.

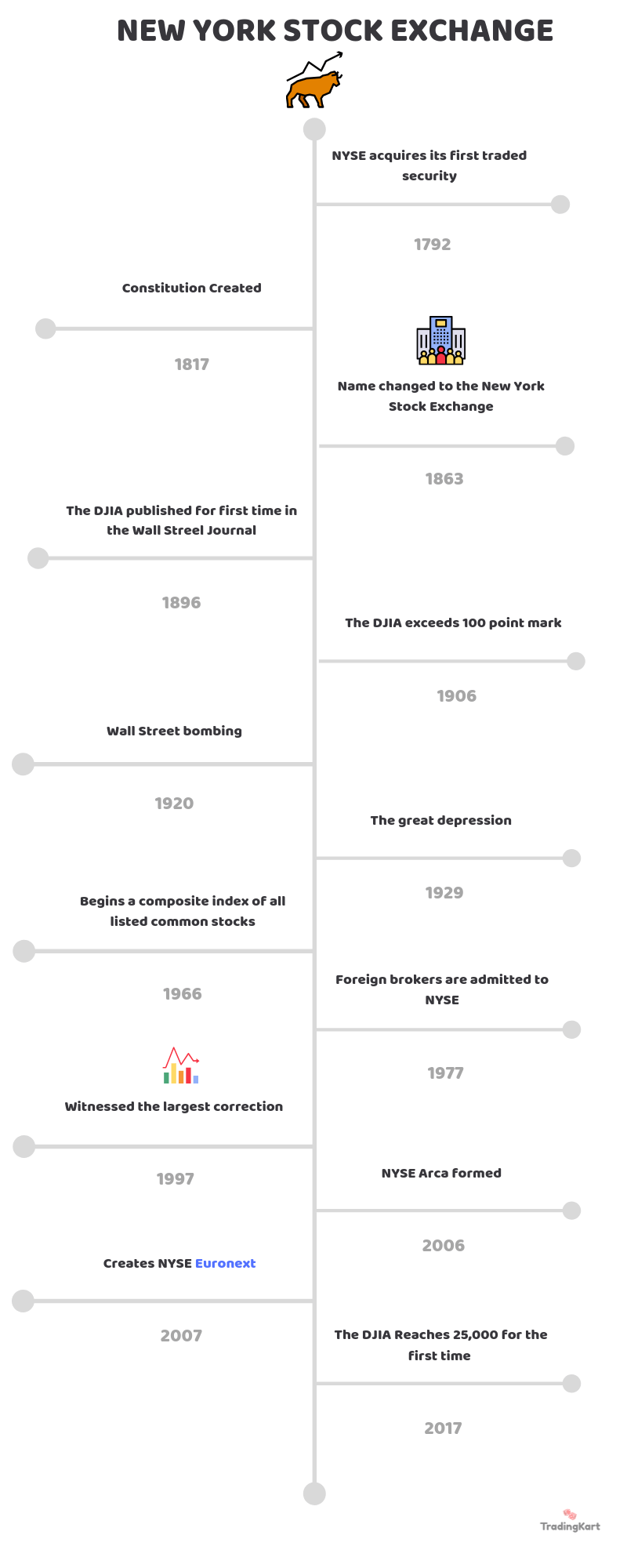

In 1792, when the operation of NYSE started there were only five securities- three government bonds and two bank stocks.

Since its inception, NYSE has been contributed significantly to the changes in American society.

Want to learn top stock investing tips to gain higher returns? Want to beat the benchmarks? have a look to compiled list of stock market tips and tricks

Its acquisition of the electronic trading exchange, Archipelago in 2006, resulted in the creation of NYSE Arca and the formation the publicly owned, for-profit NYSE Group.

Today, NYSE is owned by Intercontinental Exchange and previously, it was part of NYSE Euronext, which was formed in 2007 after the merger with Euronext.

Despite having an online platform to trade, NYSE floor trades are still used to set pricing and deal in high-volume institutional trade.

Currently, NYSE operates seven markets which give access to stocks, bonds, ETFs and options.

Among them, five are equity markets and the remaining two are options and bond markets.

NYSE, NYSE America, NYSE Arca Equities, NYSE National, NYSE Chicago are equity markets.

On the other hand, NYSE Bonds, NYSE Arca Options, and NYSE American Options are bonds and options market of NYSE.

The famous NYSE indices are the Dow Jones Industrial Average, the S&P 500, the NYSE composite, NYSE US 100 Index, etc.

The journey of NYSE started when the Buttonwood Agreement was signed by 24 stockbrokers on Wall Street in New York City in 1792.

In 1817, the stockbrokers operating under the Buttonwood Agreement introduced reforms.

After the reformation, the brokers rented a hall for trading of securities, which was previously taking place at the Tontine Coffee House.

In 1863, its name changed to the New York Stock & Exchange Board.

Before moving to the present building, it’s changed the location several times. The current building of NYSE on Broad Street opened on 22 April 1903 at a cost of US $4mn and was designated as a National Historic Landmark on June 2, 1978.

Listing in the NYSE is not only limited for American companies but foreign companies can also list their shares here.

You can see many of the oldest publicly traded companies in this exchange. Con Edison is the longest listed NYSE stock.

The Toronto Stock Exchange (TSX)

The Toronto Stock Exchange is located in Toronto, Ontario, Canada and is the 9th largest stock exchange in the world in terms of market capitalization.

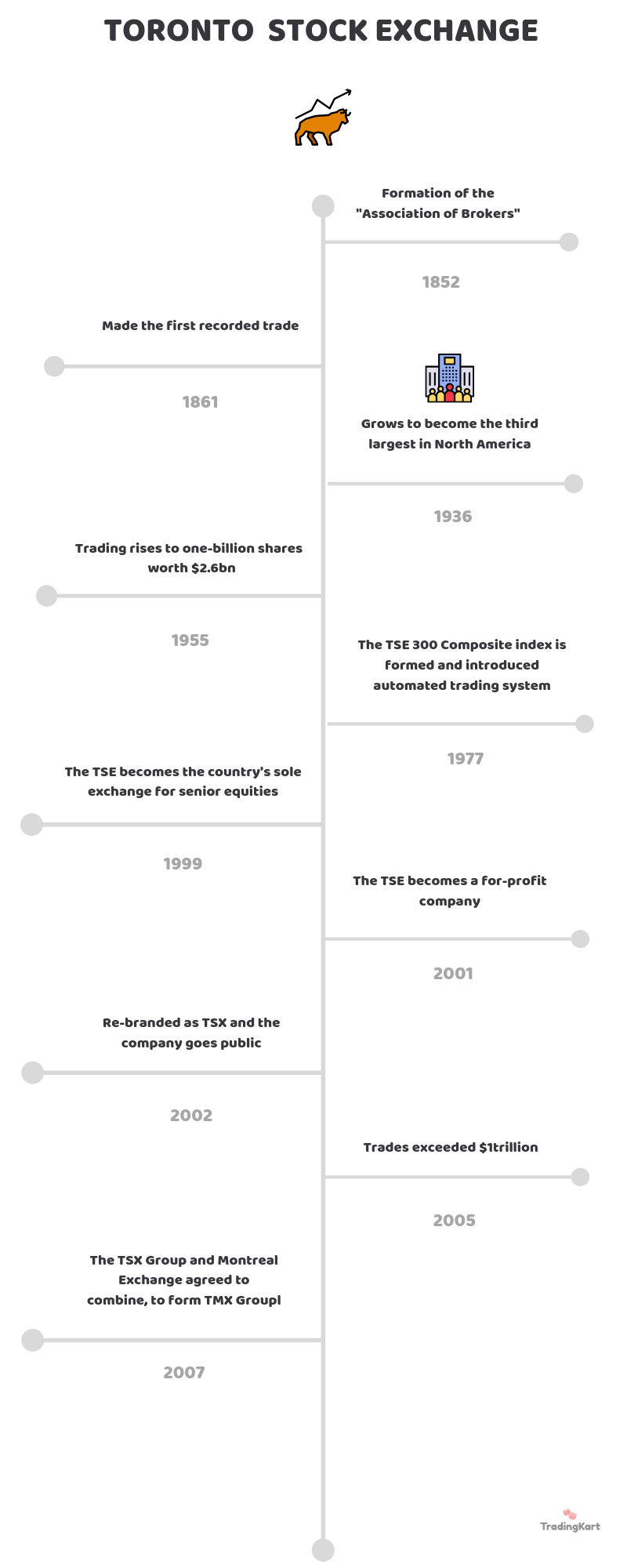

The Toronto Stock Exchange was formed by a group of Toronto businessmen in 1852.

Even though it was formally created in 1852, there are no records of its early trades. The first recorded trade of TSE was made in 1861. Then there were only 13 listed securities in TSE and they were traded for just half-an-hour every day.

In 1868, the number of securities increased to 18. The initial membership cost was $5, which increased to $250 in 1871.

During the period of World War I, TSE was closed for three months. Over the years, its size and trades increased and by 1936, the Toronto Stock Exchange grew to become the third-largest exchange in North America.

The TSE 300 Index was launched in 1977 and during the same year, it introduced an automated trading system, CATS.

In 1999, TSE became Canada’s sole exchange for the trading senior equities and in 2002 it’s been rebranded as TSX.

For the first time in its history, the trades exceeded $1 trillion in 2005 and in 2007, the TSX Group and Montreal Exchange agreed to merge, to form the TMX Group.

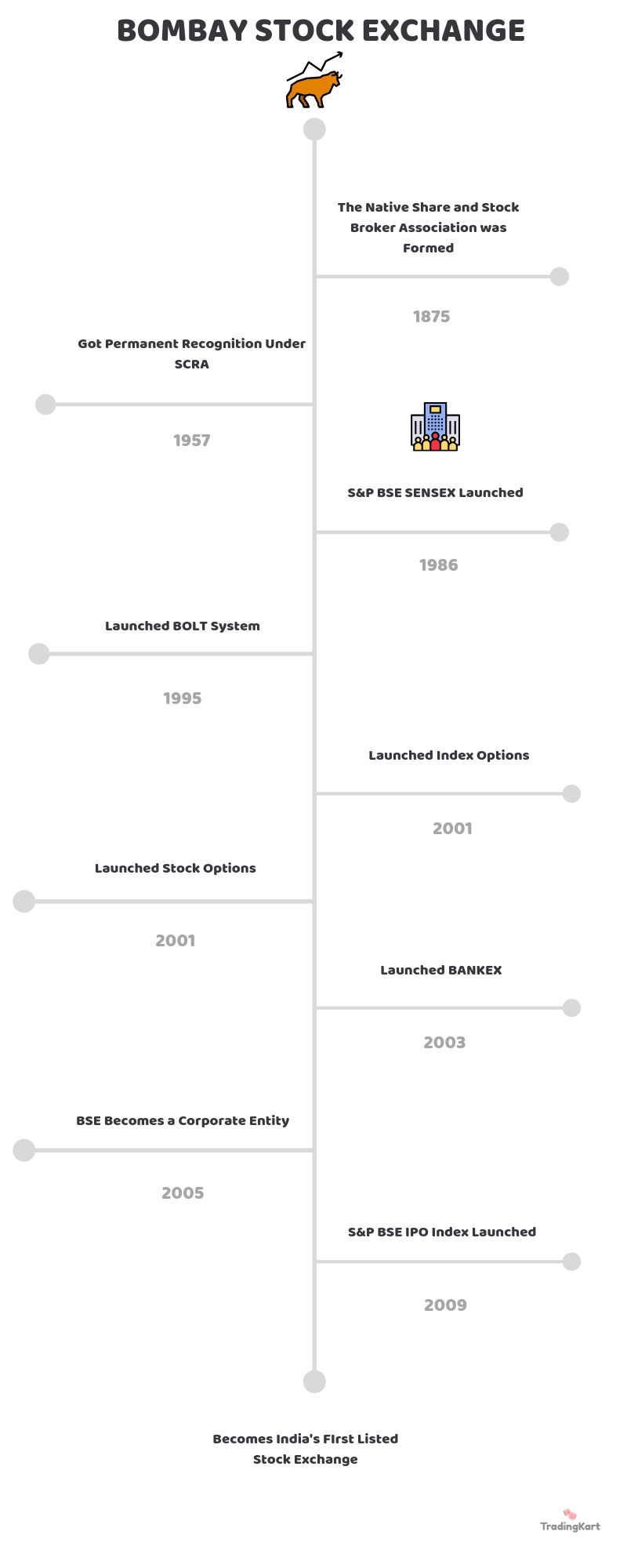

The Bombay Stock Exchange (BSE)

Even though today, India has many stock exchanges (18 official stock exchanges) approved by Securities and Exchange Board of India (SEBI), the BSE is the oldest and the most famous stock exchange among them.

Established in 1875, the headquarters of the BSE located at Dalal Street in Mumbai.

In terms of market capitalization, it’s the world’s 10th largest stock exchange and it’s the oldest stock exchange of Asia.

In 1957, the Govt. of India approved the BSE under the Securities Contract Regulation Act (SCRA).

Over the years, it has launched many indices but, the S&P BSE SENSEX is the most famous among them.

SENSEX is a free-float market-weighted index consisting of 30 companies and Reliance Industries Ltd. (RIL) is the biggest among them in terms of market capitalization (while writing this article).

An Electronic trading platform called BSE On-Line Trading (BOLT) was launched in 1995 which has a capacity of handling 8mn trade per day. The derivative segment of the BSE was launched only in 2000.

In India, the real trading in corporate securities started in 1850 when the Companies Act was passed.

The period after this saw the swift development of commercial enterprises, which made investments in shares and stocks very popular.

The shares of banks, cotton mills and loan securities of the East India Company were transacted in large volumes in Mumbai as well as in Kolkata.

The cotton industry in India witnessed a boom in the 1860s as a result of the American Civil War. This boom accelerated the momentum of trading in securities.

But the life of this boom was very short. After the Civil War, the demand for cotton underwent a steep decline and the Indian capital market witnessed its first burst in 1865.

The impact of this decline was very strong as well as long and impacted the business of many stockbrokers.

They felt the necessity of having a regular and liquid market for securities in the country.

So, in Mumbai, the stockbrokers came forward and formed the first formally organized stock exchange of the country.

It was formed as a society and named as The Native Share and Stock Brokers Association. Later, the stock market was set-up in different parts of the country.

In 1947, when India got independence from the British, there were four functioning stock exchange in the country. And the equity culture in the country was limited only among the rich.

But during the period between 1980 and 1992, the Indian capital market had undergone a widening and deepening process.

Emergence of debentures, introduction of public sector bonds, widening of mutual fund industry- all these events took place during this period.

This resulted in an increase in the number of listed companies as well as exchanges. With the increase in the number of companies, the market capitalization also picked-up.

By the end of 1991, the proportion of share owing population increased to 1.2% of the country’s total population. But unfortunately, a lot of irregularities existed in the structure and procedures of the stock market.

There was no price-priority in the trade, so the users of the market were not assured that a trade was executed at the best possible price.

The clearing and settlement procedures were also inefficient. All these problems resulted in the poor functioning of the stock market until 1990. But the period after 1992 witnessed several policy initiatives and electronic reforms.

From September 1992 Foreign Institutional Investors (FIIs) were allowed to invest in the Indian market.

Today, FIIs are an integral part of the Indian capital market and have a crucial role in the movement of the share price in India.

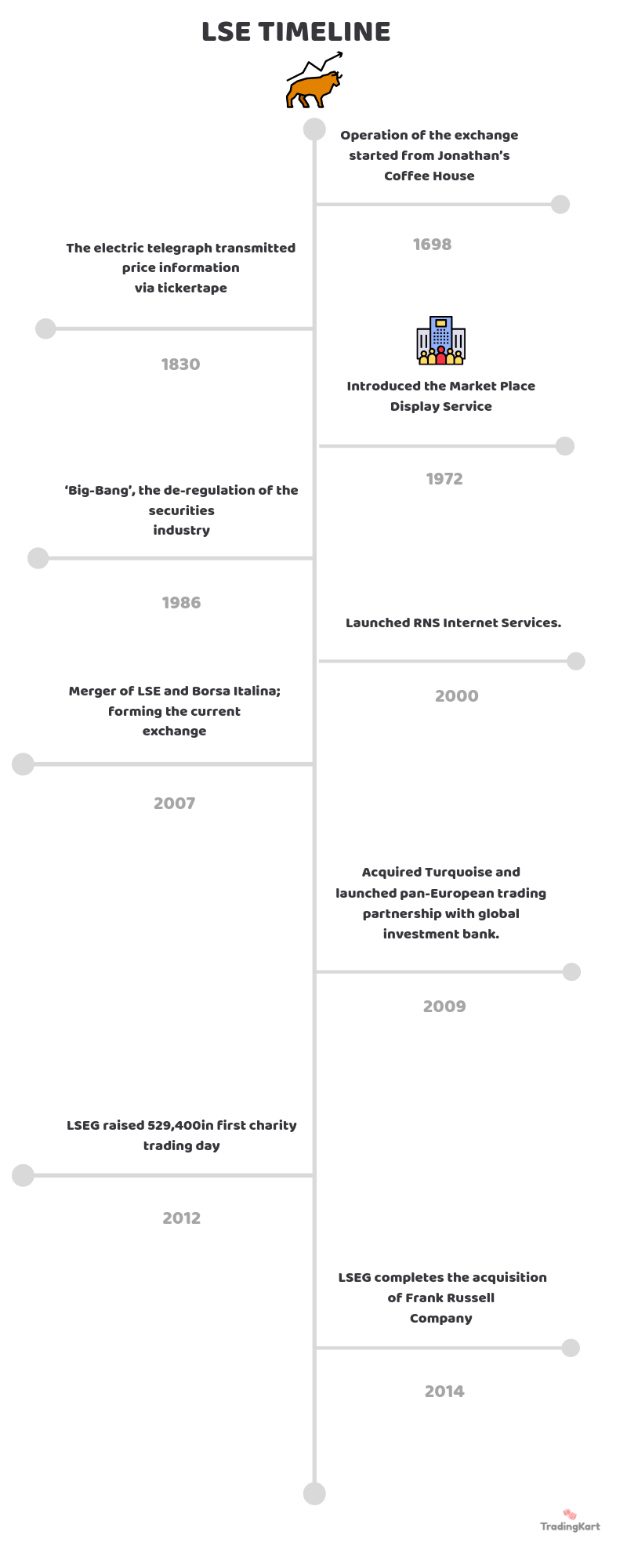

London Stock Exchange (LSE)

A history of 300 years makes LSE (London Stock Exchange) as one of the world’s oldest stock exchanges.

Today, it’s part of London Stock Exchange Group (LSEG).

The present LSEG was created in 2007 when LSE merged with Milan Stock Exchange, Borsa Italiana.

FTSE 100 index is its famous index. LSE has many electronic platforms and among them SETS, SETSqx, Turquoise, and MTS are famous.

In 1571, the Royal Exchange was founded by two English financiers as a stock exchange.

But during the 17th century, stockbrokers were banned in the Royal Exchange due to their rude manner.

This led to the opening of an exchange in a coffee shop (Jonathan’s Coffee House).

In the 1660s, the Royal Exchange building was destroyed due to the great fire, which was rebuilt and re-established in 1669 and also opened the door for stockbrokers as well as merchants.

In 1773, it was referred to as the “The Stock Exchange”.

In 1801, the opening of the Subscription room is considered as the starting of the first regulated stock exchange in London.

The stock market business witnessed a boom in the late 1950s.

With this, the necessity for a new accommodation came-up. In 1967, the work on the new the Stock Exchange Tower had started and in 1972 the operations had been shifted to the new building. The Stock Exchange became ‘The London Stock Exchange’ in 1991.

Shanghai Stock Exchange (SSE)

Re-established in 1990, SSE (Shanghai Stock Exchange) is the main board market of China and is a non-profit organization run by the China Securities Regulatory Commission (CSRC).

It’s also regarded as the Blue-Chip Market of China which has 3 tiers namely SSE 50 (consists of 50 most liquid stocks), SSE 180 (includes companies from finance, traditional industries, and energy industries; selected on the basis of higher market cap., high liquidity, good performance as well as strong dividend yield), SSE 380 (comprises of firms from consumer and energy industries with medium market cap and strong growth).

A large chunk of its market cap comes from state-owned enterprises and it’s the world’s 4th largest exchange in terms of market capitalization and also in terms of turnover.

At present, there are more than 1400 listed companies in the exchange. It classifies shares into two, A-shares (accessible to foreign investments through QFII and quoted in yuan) and B-shares (available for foreign investment and quoted in USD).

Shanghai Composite is the most famous index of SSE which encompasses A-shares and B-shares.

Japan Exchange Group (JPX)

JPX (Japan Exchange Group) is an organization that provides market infrastructure and market data.

It was established on 01 January 2013 through the business combination of Tokyo Stock Exchange Group and Osaka Securities Exchange.

It offers clearing and settlement services through a central counterpart. The main revenue sources of JPX are trading services, clearing services, listing services, and information services.

Four subsidiaries of JPX are:

- Tokyo Stock Exchange, Inc (TSE) focused on cash equity market

- Osaka Exchange, Inc. (OSE) engaged in trading activities

- Japan Exchange Regulation (JPS-R) handles the regulatory activities

- Japan Securities Clearing Corporation looking after the clearing activities

Apart from this, it’s an affiliated company, Japan Securities Depository Center, Inc., that is involved in the settlement process. JPX-Nikkei Index 400 is one of its most famous indices of the Japan Stock Exchange.

Australian Securities Exchange (ASX)

Headquartered in Sydney, ASX (Australian Securities Exchange) is one of the world’s leading and Australia’s primary stock exchange.

This integrated exchange offers listing, trading, technology, data and post-trade services to various tradable assets.

This is one of the top ten listed global securities exchanges and the largest interest rate derivative market in Asia-Pacific.

S&P/ASX 200 is its major index and its services include

- listing and issuer services,

- derivatives & OTC markets,

- trading services, and

- equity-post trade services.

ASX’s Revenue from trading services increased at a compounded annual growth rate of (CAGR) 7.3% and that from listing & issuer services rose at a CAGR of 8.6% in the last five years.

In 2017, ASX has adopted DLT (distributed ledger technology) as the basis for equity clearing and settlement system.

ASX gives strong importance on education. If offers information on various services and assets that a typical stock market offers.

Apart from this, one can find online courses and stock market simulator on the website of ASX. It also conducts seminars and webinars on financial topics.

Deutsche Börse Group

Situated in Frankfurt, Deutsche Börse is an international exchange organizers and a market infrastructure provider.

Deutsche Börse Group consists of Deutsche Börse AG and its subsidiaries.

Since 1585, it’s organized securities markets. But it remained just as a market place for many years. In the present day, it offers all the products and services that a typical exchange offers.

The famous indices of Deutsche Börse are DAX indices and STOXX indices.

If someone will tell you that Deutsche Börse doesn’t trade actively, then they are correct. Instead, it organizes trading by providing the infrastructure, defining rules and monitoring trading participants’ compliance with regulations.

It operates two of the world’s most renowned trading platforms, Frankfurt Stock Exchange and Xetra, where prices are determined on the exchange.

It also owns Tradegate Exchange, a stock exchange for private investors. Through Eurex, it organizes the world’s largest derivative market.

The European Energy Exchange (EEX), ECC (world’s leading clearing infrastructure) and 360T (the fastest FX trading platform) are operated by Deutsche Börse.

Being the owner all these leading companies helped Deutsche Börse to get into the list of the world’s most highly valued exchanges.

Euronext N.V.

Euronext is the largest stock exchange in the European continent with more than 1,200 companies listed and a €3.8trillion market cap (as of June 2019).

It operates markets in Belgium, France, Ireland, the Netherlands, Norway, Portugal, and the United Kingdom. Since 2014, it’s listed in Paris, Amsterdam, Brussels, and Lisbon.

Today, it operates non-regulated activities in 16 countries.

Formed in 2000, after the merger of exchanges in Amsterdam, Paris, and Brussels, it was a part of NYSE from 2007 to 2014 and was known as the NYSE Euronext.

But later it had been spun off to form Europe’s biggest exchange. At present, Euronext provides advanced market data services and a range of indices and index solutions.

Its trading platform is known as Optiq, a platform for trading algorithmic.

Euronext is the best place for listing SMEs of all sizes and sectors.

Through its dedicated SME indices, it helps small and medium-sized enterprises to raise funds for their businesses. Currently, more than 930 SMEs are listed in Euronext.

Its quick listing procedures, flexible eligibility criteria, and broader investor base makes it a paradise for listing SMEs. It has a pre-IPO program to educate the unlisted SMEs about the benefits of listing in an exchange, the procedures and the criterion of IPOs.

In the last five years, this exchange has successfully listed 250 companies and raised €59bn through equity and bonds.

The Stock Exchange of Hong Kong (SEHK)

The Stock Exchange of Hong Kong is the third-largest in Asia in terms of market capitalization and fourth single largest in the world.

SEHK is a wholly-owned subsidiary of Hong Kong Exchange and Clearing Limited (HKEX).

Established in 1891, today there are more than 2300 listed companies (as of 2018) in this exchange and it holds the tag of the fastest-growing stock exchange in Asia. It works closely with Securities and Futures Commission (SFC) to regulate listed issuers and administers listing, trading as well as clearing rules.

The Hang Seng Index is its famous index which consists of 50 companies and the aggregate market cap of these companies is more than 58% capitalization of the Hong Kong Stock Exchange.

The birth of SEHK is related to the establishment of the Association of Stockbrokers in Hong Kong. But, it’s established as an exchange only in 1980 and the trading started in 1986. The market crash of 1987 brought an entire reform in the security market of Hong Kong and also witnessed a major change in regulation.

This led to the formation of SFC in 1989.

Over the years, it’s undergone many infrastructural changes. In 1986, it’s introduced a computer-based trading system and launched the Automatic Order Machine and Execution System (AMS) in 1993.

But in the year 2000 AMS has been replaced with the third-generation system.

Those are some of the worlds top stock exchanges. Stay tuned for more updates on this article.